Residential depreciation calculator

The Modified Accelerated Cost Recovery System put simply MACRS is the. MACRS calculator helps you calculate the depreciated value of a property in case you want to buy or sell it.

Your Credit Score Will Determine Whether You Qualify For A Mortgage The Amount Of Money You Qualify For In A Mortg Sonegacao Emprestimos Sonegacao De Impostos

Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself.

. To use a double-declining credit select the declining ratio and then raise the depreciation factor to 2. In this step you take your cost basis from step one and divide it by the years that your rental property is considered to have a useful life. A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and tear of a property on their tax return.

After choosing the method enter the cost amount of the financial asset. Double Declining Balance Method. Property 1 days ago Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in.

The core calculation is for straight line depreciation as the name suggests it is a straight line drop in asset value. Divide Cost by Lifespan of Property. There are many variables which can affect an items life expectancy that should be.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. It provides a couple different methods of depreciation. D i C R i Where Di is the depreciation in year i C is the original purchase price.

The Washington Brown a property. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation.

Calculate annual depreciation deduction. Section 179 deduction dollar limits. What Is Bonus Depreciation In 2022 Tax.

This calculator is geared towards residential rental property. How to Calculate Depreciation on a Rental Property. What is the depreciation rate for real estate.

Property Depreciation Calculator This is the first calculator to draw on real properties to determine an accurate estimate. The recovery period varies as per the method of computing depreciation. Once you have the building value simply divide it by 275 the years of useful life for your rental property to get the yearly.

Depreciation asset cost salvage value useful life of asset 2. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. This limit is reduced by the amount by which the cost of.

Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the. According to the IRS the depreciation rate is 3636 each year. Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only.

Amaze Yourself With Heart Throbbing Facilities For The Coming Projects By Prabhupremgroup Best Location Township Power Backup

Smats Have A Fantastic Australian Property Tax Calculator Thats Free To Use Property Tax New Property Names

Commercial Loan Amortization Schedule How To Create A Commercial Loan Amortization Schedule Download This Co Amortization Schedule Commercial Loans Schedule

What Is Bonus Depreciation In 2022 Tax Reduction Bonus Net Income

General Journal Template Excel Elegant General Ledger Spreadsheet Spreadsheet Template Business Template Small Business Bookkeeping

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Loan Repayment Schedule Investing Investment Property

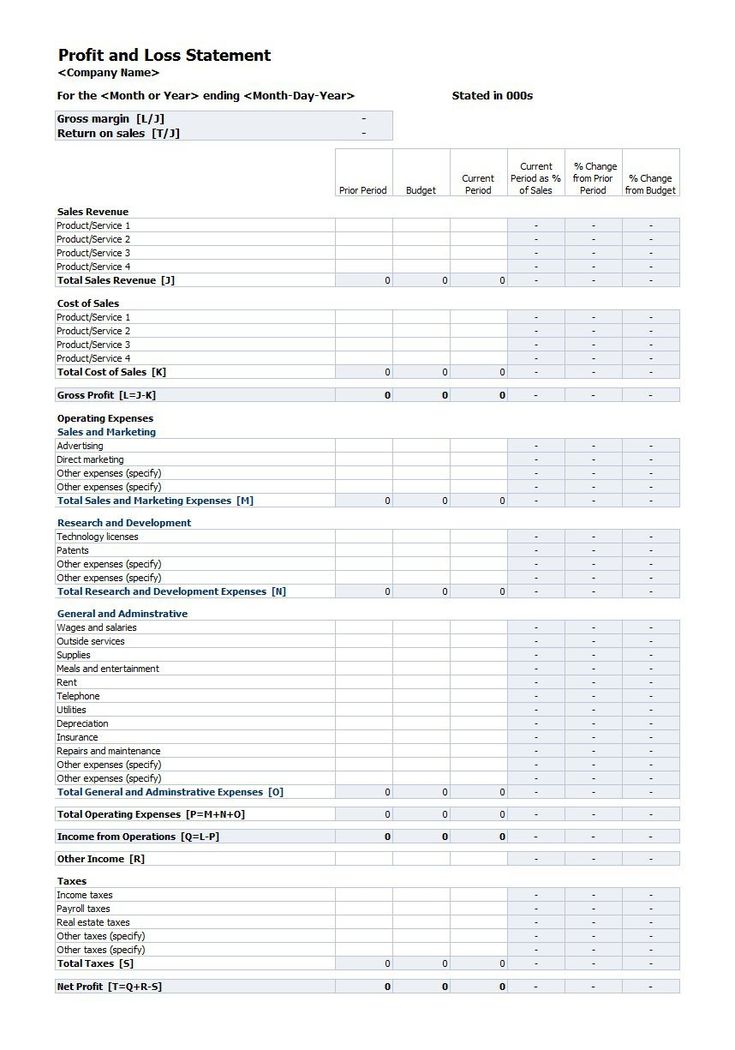

Expense And Profit Spreadsheet Profit And Loss Statement Statement Template Cash Flow Statement

Who Says You Cant Buy Happiness When You Can Buy Your Own Home Prabhuprembuildcon Prabhuprem Group Family Values Gaming Logos This Is Us

Meaningful Wednesday 𝐀𝐏𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 𝐎𝐑 𝐃𝐄𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 Abs Net Worth Meaningful

Inventories Office Com List Template Free Business Card Templates Business Template

Untended Depreciation Schedule Sample Schedule Templates Schedule Schedule Template

Profit And Loss Template 07 Profit And Loss Statement Statement Template Spreadsheet Template

Why The 2 Percent Rule Matters For Rental Property Investing Under 30 Wealth Renting Out Your House Real Estate Investing Rental Property Rental Property Management

Gross Domestic Capital Formation Mind Map Investing Domestic

Meaningful Wednesday 𝐀𝐏𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 𝐎𝐑 𝐃𝐄𝐏𝐑𝐄𝐂𝐈𝐀𝐓𝐈𝐎𝐍 Abs Net Worth Meaningful

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet