Cost plus markup formula

So margin 200 1000 20. From the formula of markup percentage we know.

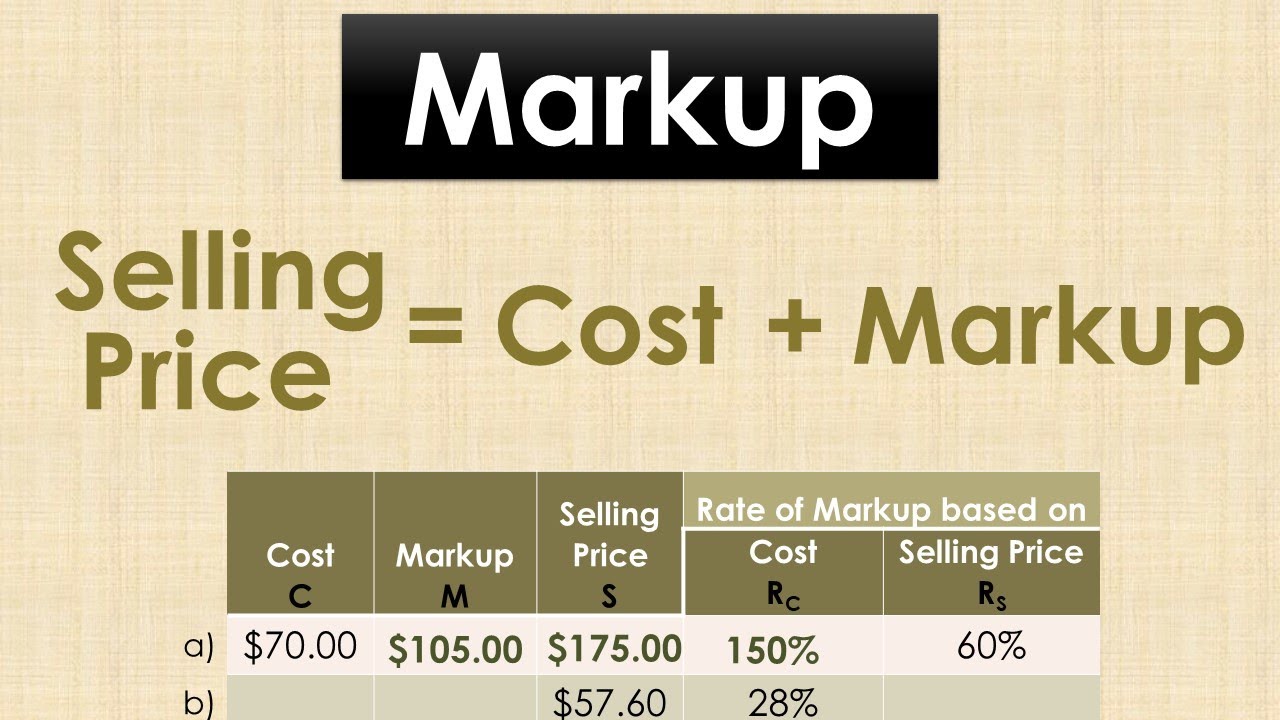

Markup Selling Price Cost With Solved Problems Youtube

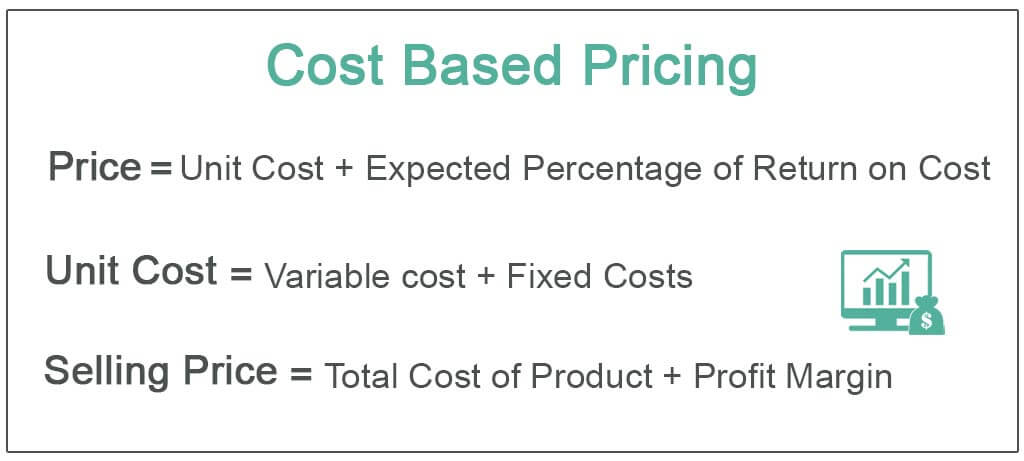

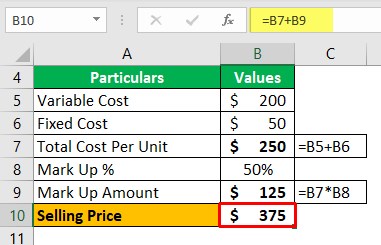

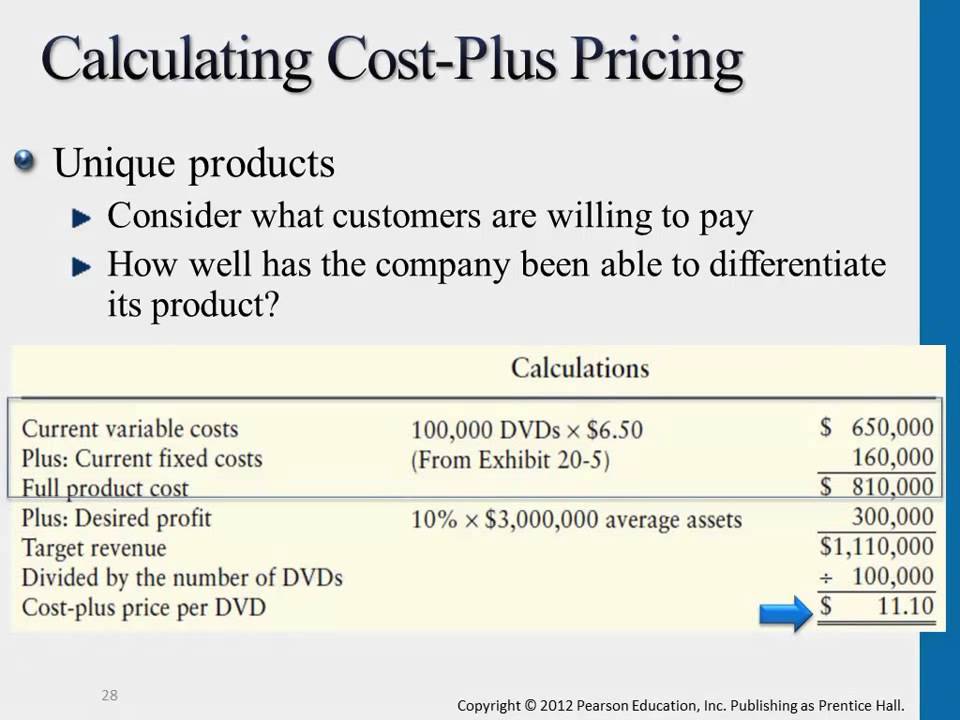

The cost-plus pricing formula is calculated by adding material labor and overhead costs and multiplying it by 1 the markup amount.

. Pros and cons of a cost plus pricing strategy. You could consider this a benchmark. But if we look at the markup we have a cost of 800 which is uplifted by 200 to.

Profit is a difference between the revenue and the cost. When thinking about pricing in a. Cost plus pricing is a relevant product pricing strategy for physical products as it involves adding a markup to the original cost of the product.

For example when you buy. This is essentially the plus in the cost plus method. At a markup on cost of 150 the gross margin on the product will be 9750.

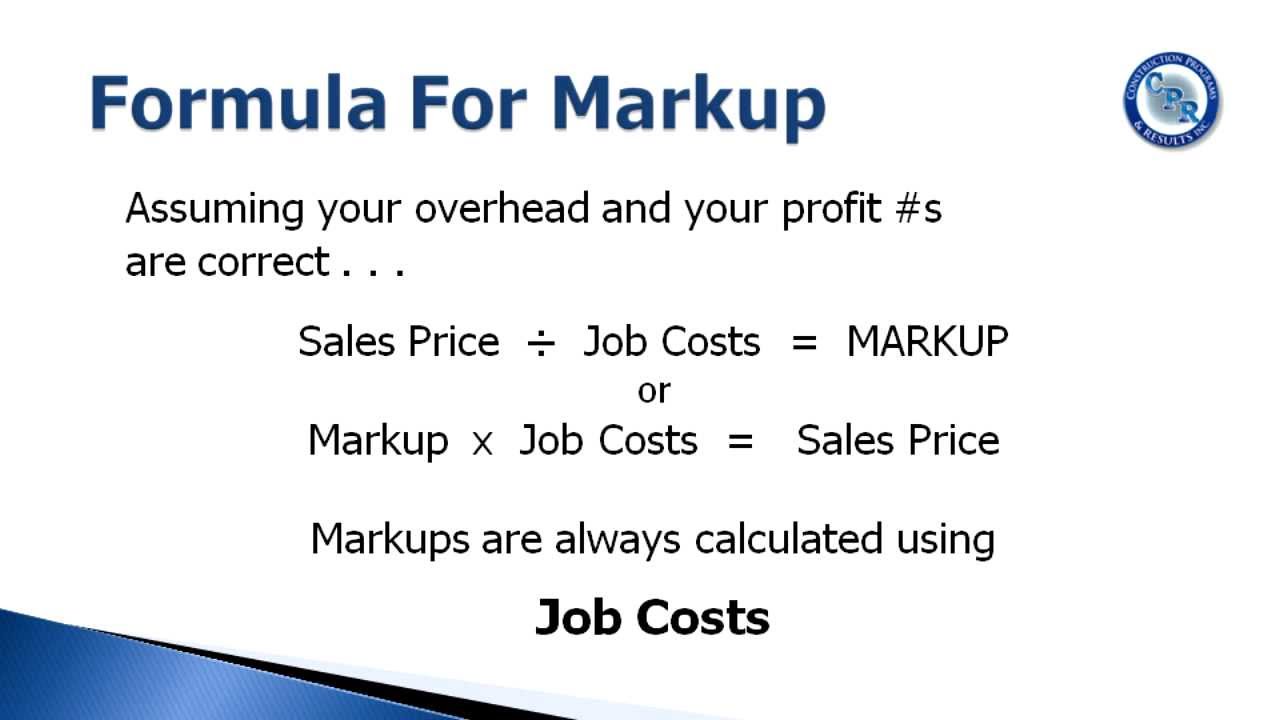

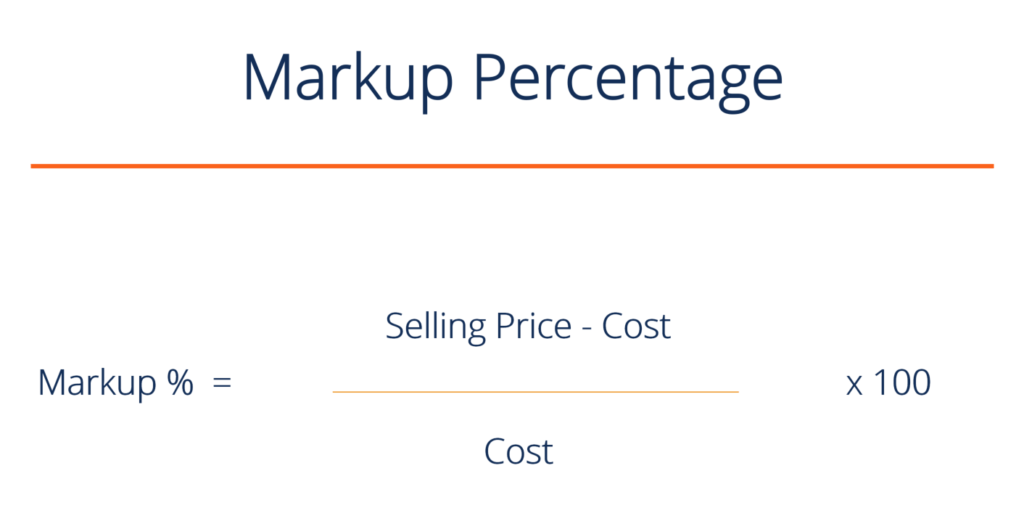

The marketup formula is as follows. Markup selling price cost cost x 100. Under the latter approach companies first consider demand and.

Now you want to add a 40 Markup to the. For remodeling you will often hear the phrase 10 and 10 meaning 10 overhead and 10 profit for a total markup of 20. Cost-plus pricing is in contrast to market-based pricing.

Thus if we formulate the transfer price under Cost Plus Method it would be equal to COGS Markupwhere Markup is arrived by COGS x Markup. Cost plus pricing involves adding a markup to the cost of goods and services to arrive at a selling price. The selling price of a product or service can be calculated step-by-step as well discussed below.

Thus TP COGSx 1 M. Cost-plus Pricing Formula Direct Material Direct. If we talk about margin then we are making 200 by selling this product at 1000.

Adding Percentage Markup to the Cost Price Example For example your wholesale price Cost Price of a product is 25. Under this approach you add together the direct material cost direct. In our calculator the markup formula describes the ratio of the profit made to the cost paid.

The retail markup calculation also called markup pricing formula. Where the markup formula is dependent on Selling Price the final sale. Overhead costs are costs that cant directly be.

Markup Percentage 100 500 150150 100 350150. Markup Percentage 100 Sale price Cost PriceCost. Another term for cost-plus pricing is markup pricing.

Gross margin Markup on cost x Cost price Gross margin 150 x 6500 Gross margin 9750. The biggest pro of a cost plus pricing strategy is that its simple. The cost-plus approach is the simplest of pricing methods.

Then a market-based markup is added to that cost to account for an appropriate profit. The most reliable way to apply the cost plus. If you decide that the cost-based pricing strategy is the right one for your small business use the formula to get started.

Cost Plus Pricing Formula.

Full Cost Plus Pricing How To Calculate Price Using Full Cost Plus Method Youtube

Cost Based Pricing Definition Formula Top Examples

Unit 13 The Marketing Mix Price Phuc S Website

The Transactional Net Margin Method Explained With Example

Cost Plus Pricing Definition Method Formula Examples Video Lesson Transcript Study Com

Cost Based Pricing Definition Formula Top Examples

Calculating Cost Plus Pricing Youtube

The Cost Plus Method With Example Transfer Pricing Asia

Cost Based Pricing Pricing Based On Costs

Using Markup To Calculate Your Sales Price Youtube

Cost Based Pricing Pricing Based On Costs

Cost Plus Pricing Definition Example Advantage Accountinguide

Cost Plus Pricing Definition Method Formula Examples Video Lesson Transcript Study Com

How To Calculate Markup Prices Calculator

Markup Calculator Calculate The Markup Formula Examples

What Is Cost Plus Pricing

Cost Based Pricing Pricing Based On Costs